Is Bitcoin ready to shatter its all-time highs? Today's market is seeing a dramatic movement, with the price of Bitcoin surging past levels unseen since past month. Traders are buzzing about {potentialcatalysts driving this rally, ranging renewed institutional adoption and a surge in buying pressure. Analysts are expecting continued growth in the near future, but it's important to remember that the market is volatile.

- Contributing to today's surge are

- {Potential future price targets|Analysts predict Bitcoin could reach|Price forecasts for Bitcoin in the coming weeks

Track BTCUSD Live: Real-Time Bitcoin Price Tracker

Want to stay on top of the volatile sphere of copyright? Our live BTCUSD tracker delivers real-time data on the price of Bitcoin compared with the US dollar. Regardless if a seasoned trader or just beginning your copyright journey, our easy-to-use platform gives you with the up-to-the-minute insights you need to make informed choices.

- Explore price charts and patterns

- Receive instant notifications on significant price shifts

- Remain ahead of the curve with our comprehensive monitoring tools

Is There Now a Good Time to Buy Bitcoin? Analyzing Current Prices

Bitcoin's price/value/cost has been on a rollercoaster/wild ride/bumpy journey lately, leaving many investors wondering if now is the right time to buy/invest/purchase. Experts/Analysts/Traders are divided/split/mixed on the outlook for Bitcoin, with some predicting further growth/gains/increase and others forecasting a correction/dip/decline.

Here's a look at some factors to consider when making your decision/choice/call:

* **Current Market Sentiment:** The overall market sentiment/mood/attitude is currently bullish/bearish/neutral, which can influence/affect/impact Bitcoin prices.

* **Bitcoin Fundamentals:** Despite recent volatility/fluctuations/swings, the underlying technology and adoption of Bitcoin remain strong.

* **Regulatory Landscape:** Government regulations/laws/policies surrounding cryptocurrencies are constantly evolving, which can create/cause/generate uncertainty in the market.

Ultimately, the decision of whether or not to buy Bitcoin is a personal/individual/unique one. It's important to do your research/conduct due diligence/carefully consider all factors before making any investment decisions/choices/moves.

Bitcoin Price Prediction: Where Will BTC Go Next?

The volatile nature of Bitcoin has captivated traders and investors alike. Will the king of copyright continue its bull run? Or is a correction on the horizon?

Analysts are split on the future direction of BTC, with some predicting significant gains and others warning of risks.

Factors influencing Bitcoin's price include government policies, big player involvement, and technological advancements.

It's important to remember that predicting the future of any cryptocurrency history asset, especially a high-risk one like Bitcoin, is inherently difficult. Stay informed before making any investment decisions.

Decoding Today's Bitcoin Market: Price Trends and Predictions

The Bitcoin market remains a unpredictable landscape, with rates constantly fluctuating in response to a multitude of elements. Investors are closely scrutinizing recent trends to achieve valuable clarity into the market's current momentum.

Several key markers are currently suggesting a probable change in the Bitcoin market. The activity of recent exchanges has been remarkably high, suggesting growing demand.

Furthermore, technical analyses reveal a optimistic sentiment in the market. Several key support levels have been tested, indicating potential further rising price movements.

Nevertheless, it is essential to remain wary as the market remains subject to volatile changes. It is crucial for participants to conduct thorough analysis and develop a well-defined strategy that aligns with their threshold.

Bitcoin's Fluctuating Value: Understanding Fluctuations in Price

Bitcoin, a pioneering copyright, is renowned for its significant price volatility. The value of Bitcoin can swing dramatically within brief periods, presenting risks to investors and traders alike.

Numerous factors contribute to this volatility, among them regulatory uncertainty, investor psychology, technological advancements, and international events.

- Comprehending these influences is essential for anyone involved in the Bitcoin market.

- Hedging strategies can help mitigate some of the risks associated with price swings.

While volatility poses risks, it also offers opportunities for profit. Savvy investors can leverage Bitcoin's fluctuating nature to their advantage, but it requires strategic thinking.

Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Justine Bateman Then & Now!

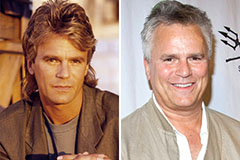

Justine Bateman Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!